- Bitcoin News Weekly

- Posts

- Bitcoin News Weekly #11

Bitcoin News Weekly #11

💥 The Spot Bitcoin ETFs Arrive with a BANG

TLDR:

The SEC approves 11 Spot Bitcoin ETFs.

Spot Bitcoin ETFs acquire 24,209 BTC in just two days.

Cathie Wood doubles down, predicting a bull case price target of $1.48M.

The Department of Justice announces that it holds 120,000 bitcoin.

Hey, it's Bam! I’m excited to bring you another edition of Bitcoin News Weekly! Haven't subscribed yet? Click below to get the latest breaking Bitcoin News delivered directly to your inbox every Monday!

After one of the most eventful weeks in Bitcoin history, the spot ETFs have finally arrived! While the ETFs garnered most of the headlines, let's delve into all the other significant developments that occurred this week in the world of Bitcoin.

LATEST NEWS

🙌 Adoption:

The Toyota Center Tbilisi in Georgia now accepts Bitcoin and Tether as payment for car purchases.

Unchained announces institutional lending, allowing customers to access over $3 million in liquidity from their treasuries while minimizing counterparty risk.

Cathie Wood, Ark Invest CEO, doubles down on her 2030 Bitcoin predictions: bear case $258,500, base case $682,000, bullish projection $1.48M.

⚖️ Legal:

The DOJ announces holding 120K bitcoin, valued over $5.4 billion, with a price basis of $71 million, establishing the US government as a major bitcoin holder.

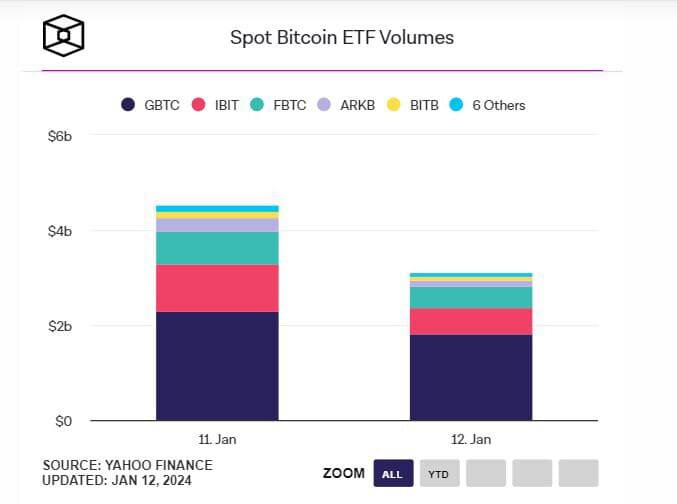

The SEC approves 11 Spot Bitcoin ETFs on January 10th, and within two days, they traded a volume of $7.7 billion.

Hester Pierce, SEC Commissioner, writes a scathing letter denouncing the extended duration it took for her agency to approve the ETFs.

📈 Markets:

Standard Chartered predicts inflows of $50-$100 billion into spot Bitcoin ETFs in 2024.

⛏️ Mining:

Bitcoin's hashrate hits a new all-time high of 532 EH/s.

Bitcoin miners' outflow surges to a six-year high, with over $1 billion worth of bitcoin sent to exchanges.

Bitcoin miners in the UAE use ANTSPACE HK3 containers for hashing in the desert. These $70,000 containers have a 1030KW capacity and hold 210 miners.

🗳️ Politics:

Prospera, a special economic zone in Honduras, becomes the first jurisdiction worldwide to officially recognize Bitcoin as a unit of account.

Senators Wyden and Lummis call for an Inspector General probe into the SEC after their X account hack led to a false Bitcoin ETF approval announcement.

Shopify's COO criticizes the SEC's sluggish approval of the Bitcoin ETF, blaming the government for stifling innovation and ignoring figures like SBF.

Looking for the simplest Bitcoin-only hardware wallet?

Bam’s 2 Sats:

The eagerly awaited spot Bitcoin ETF has finally arrived, capturing the attention of the entire space. Some argue it was a "sell the news" event, as the price didn't experience the “God candle” that many had anticipated. However, don't be disheartened by the short-term effects. Let's delve into what happened and why I believe this marks just the beginning of a captivating bull market driven by significant institutional involvement.

In just two days, the traded volume was remarkable, surpassing $7.7 billion. Despite Bitcoin reaching yearly highs of $49,000, it retraced sharply, briefly touching $41,500—a nearly 15% decline in less than 48 hours.

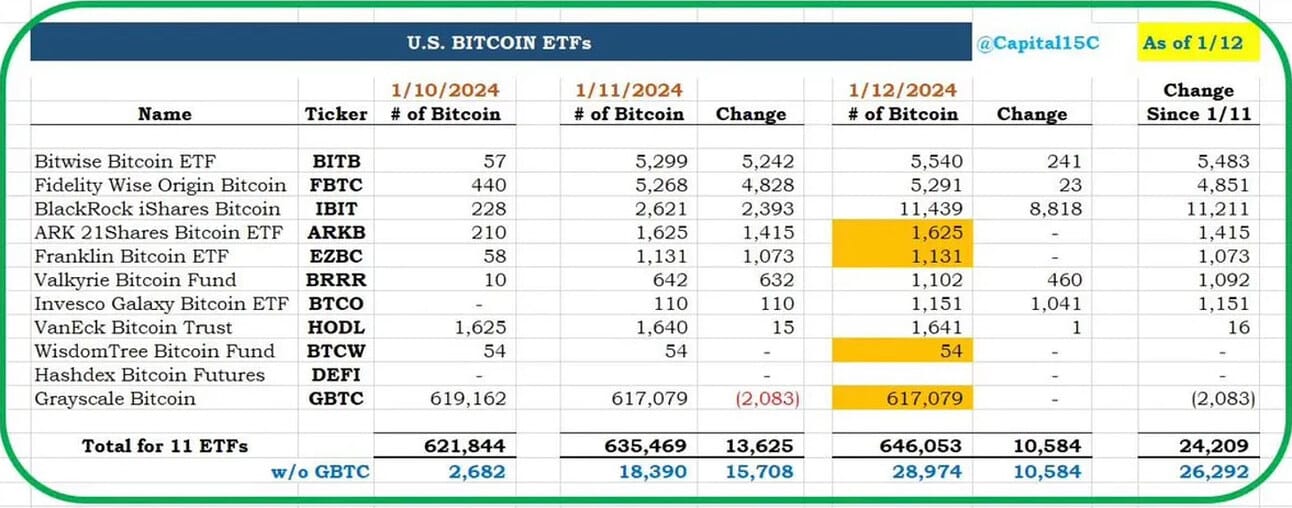

Speculation is rife that the reason behind this is Grayscale experiencing net outflows, with investors aiming to realize gains or shifting to other ETF providers offering significantly lower fees. Some argue that Binance was liquidating their derivative books, and it's possible that many speculators decided to take profits after months of higher prices in anticipation of approval.

Let's not overlook the signal amid the noise. Not only do net inflows remain positive, but over $1 billion in new money has entered the system. The various ETF providers accumulated an additional 24,209 bitcoins, with BlackRock taking the lead with 11,439, representing almost 46% among the 11 entities.

The key point is to broaden our outlook and adopt a longer-term perspective. Standard Chartered suggests we have yet to see $50-100 billion inflows into spot Bitcoin ETFs this year. Furthermore, with the halving in April reducing issuance, and over 70% of bitcoins held by long-term holders unwilling to sell at these prices, we could be on the brink of an unprecedented supply shock.

Stay Humble & Stack Sats,Bam

Are you a Bitcoiner or a Bitcoin company focused on promoting hyperbitcoinization? Reach out directly to [email protected] to discuss how we could work together.

P.S. … We're eager to hear your thoughts and suggestions on how to make this newsletter the go-to Bitcoin resource in your inbox. Don't be shy—hit us with a reply!

Reply