Happy Monday Bitcoiners - it’s Bam with another weekly update!

Each week, we condense the most impactful news releases into a concise, easy-to-read update so you’re always in the know!

Notable events this week include 👇

150 million Walmart shoppers just got Bitcoin as a new payment option.

UK cops now hold 61,000 BTC after the biggest crypto bust ever.

CME gaps are about to vanish with 24/7 BTC futures trading coming soon.

Let’s dive in⚡

Take the Stress Out of Self-Custody

Self-custody shouldn’t mean clunky hardware or a seed phrase that could cost you all your Bitcoin if it’s lost.

Bitkey fixes that.

From the team behind Square and Cash App, Bitkey is a secure multisig wallet that makes self-custody simple:

• No seed phrase to memorize

• Easy recovery if something goes wrong

• Built-in inheritance for your loved ones

Simple. Secure. Stress-free.

Latest News 📰

🙌 Adoption

Kaleidoswap executes the first RGB20 stablecoin swap (tUSDT) on Lightning mainnet (no testnet, no demo), proving RGB and Lightning now enable trustless, private, decentralized asset trading on Bitcoin.

Walmart will now accept Bitcoin and other cryptocurrencies for payment at all its stores through OnePay Cash, the fintech app it launched in 2021.

OpenAI launches Sora 2 and users are already making Bitcoin videos featuring well-known characters like Rick and Morty to orange-pill the masses.

⚖️ Legal

US Treasury fixes the CAMT (Corporate Alt. Minimum Tax) issue, sparing companies from being taxed on unrealized Bitcoin gains, preventing forced BTC sales and boosting US corporate Bitcoin adoption.

Yadi Zhang, a Chinese national, has pleaded guilty in the UK after the world’s largest BTC seizure ($6.7B). The stolen 61,000 BTC now sits in limbo, either returned to victims in China or absorbed by the UK state.

Wisconsin lawmakers have introduced the “Bitcoin Rights” bill (AB471), exempting self-custody, nodes, mining, staking, and blockchain software from money transmitter licensing.

📈 Markets

BlackRock's IBIT Bitcoin ETF now supports in-kind transfers, allowing authorized participants to swap Bitcoin directly against shares, as IBIT overtakes Deribit as world’s largest Bitcoin options venue.

CME Group, the $95B derivatives giant, announces it will expand Bitcoin and crypto futures/options trading to 24/7 beginning in early 2026, pending regulatory review.

S&P500 is up 106% since 2020 in dollar terms but denominated in Bitcoin it’s down 88%.

🏦 Treasury

Tether purchases 8,888 BTC from Bitfinex, bringing its total holdings to about 86,335 BTC. At current prices, that’s over $10.1 billion, making Tether the second-largest corporate holder of Bitcoin after MSTR.

Coinbase now custodies more than 2.9 million BTC, holding one-third of all Bitcoin owned by treasury companies and over 14.5% of the total circulating supply.

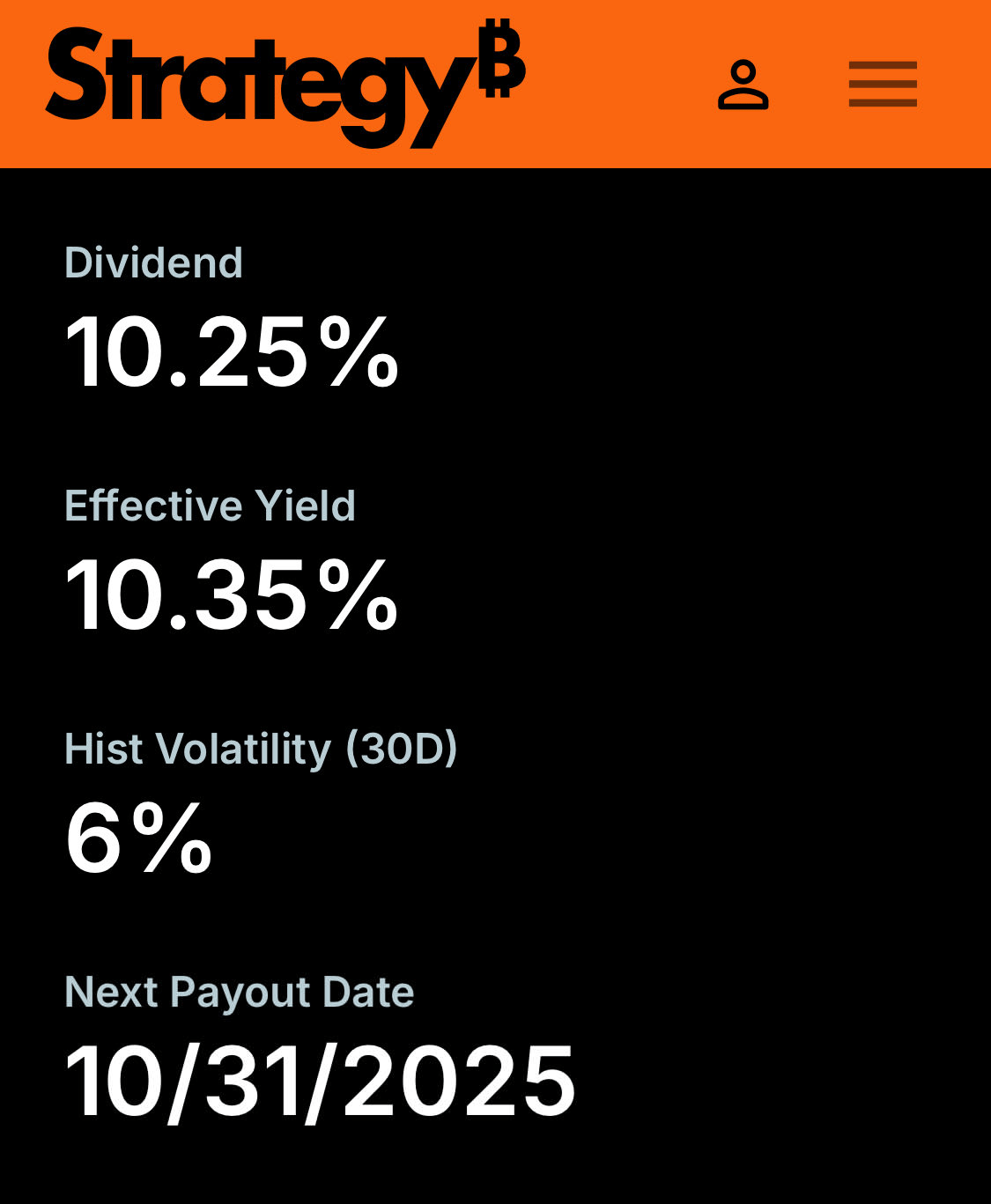

Robinhood has begun listing Strategy’s preferred stocks, including $STRC with a 10.25% yield, but sparked controversy after raising margin requirements from 50% to 100% just hours after listing.

⛏️ Mining

Bitcoin Core undeprecates the datacarrier and datacarriersize config options, giving node operators full control over OP_RETURN txns, including whether to relay them and how much data they can carry.

New York Senate Bill S.8518 proposes a tiered excise tax on Bitcoin mining energy use, exempting miners powered by renewables and directing revenue to families needing help with energy bills.

CleanSpark ends its fiscal year with record growth, expanding its Bitcoin treasury to over 13,000 BTC, increasing monthly production by 27% year-over-year, and improving fleet efficiency by 26%.

🗳️ Politics

Swedish politicians Dennis Dioukarev and David Perez propose creating a strategic Bitcoin reserve to hedge against inflation, urging Sweden to “join the digital arms race.”

The Fed is flying blind on jobs data as the BLS confirmed its site won’t be updated until the government shutdown ends, delaying last week’s Nonfarm Payrolls and Unemployment Rate reports.

ECB President Christine Lagarde called the “democratic process” a “drag,” expressing frustration that her push for a Digital Euro is being slowed by public scrutiny and parliamentary debate.

🧠 Bitcoin Trivia 🧠

Bam’s 2 Sats 🧢

The Debasement Trade & The Potential Flywheel Effect

The Debasement Trade

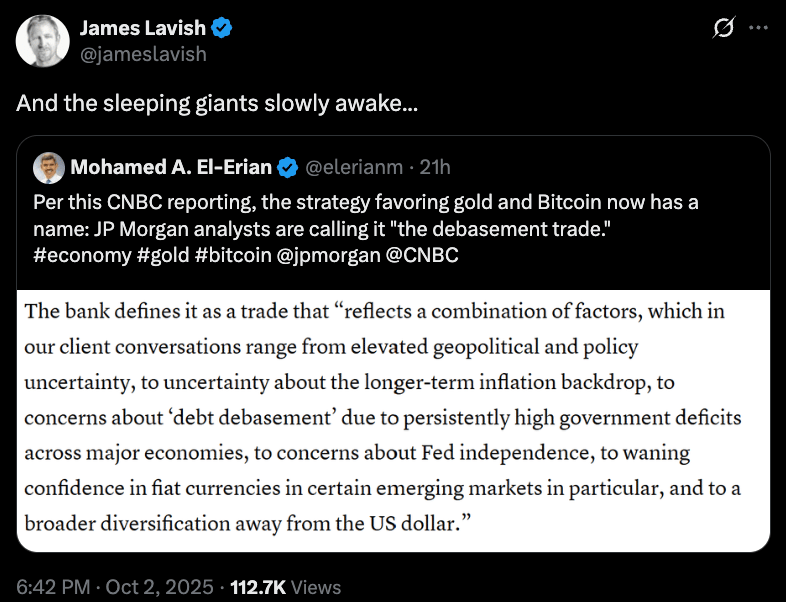

Uptober has arrived, bringing volatility with it. Bitcoin just printed a ~$15K weekly candle, hitting new all-time highs above $125K. Bearish sentiment has vanished almost overnight, replaced by what JPMorgan analysts call “The Debasement Trade.”

It’s a fitting title. As The Prophet noted on X, this isn’t just a rally but a global unit-of-account fracture. In dollar terms, everything appears to be booming, but in gold, the illusion fades as stocks and real estate flatten or fall. Through the Bitcoin lens, the truth is even clearer: everything else is losing value.

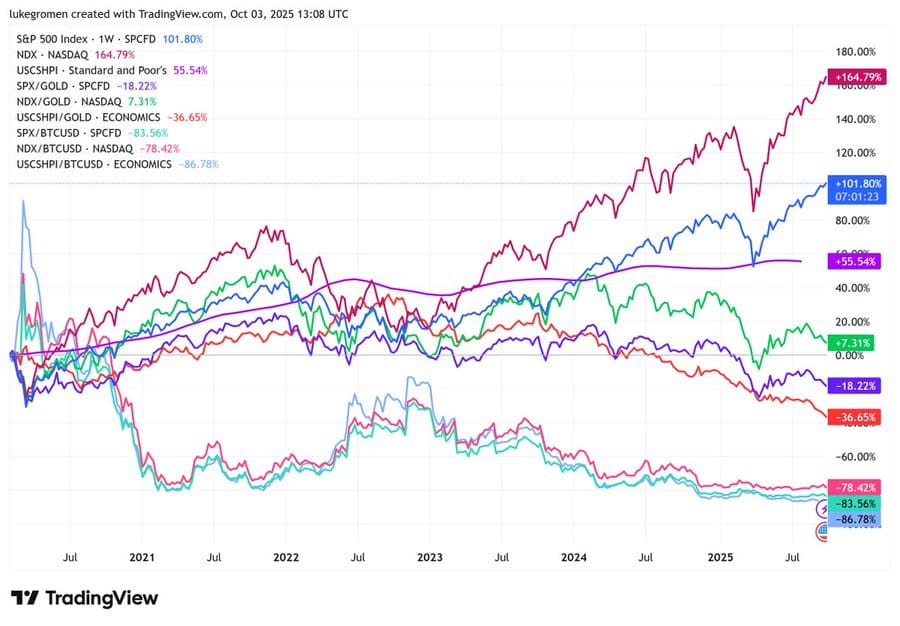

Luke Gromen broke it down. Since COVID:

In USD terms, the Nasdaq 100 is up 165%, the S&P 500 up 102%, and U.S. home prices up 56%.

In gold terms, those numbers shrink to +7%, +18%, and –37%, respectively.

In Bitcoin terms, the picture flips completely: Nasdaq down 78%, S&P down 84%, and home prices down 87%.

In other words, everything is getting cheaper in Bitcoin terms. The only real change is that the mainstream is finally starting to notice.

by James Lavish

Strategy’s Flywheel Effect

Meanwhile, Robinhood quietly added Strategy’s preferred stock ($STRC) to its platform this week, coinciding with Strategy’s dividend yield increase from 10.0% to 10.25%. The market responded quickly, driving strong demand and pushing $STRC to its highest weekly close ever at $99.

Here’s an interesting twist: Robinhood users can borrow at under 10%, creating a clear arbitrage opportunity between borrowing costs and the 10.25% STRC yield.

As STRC’s price nears $100, it reflects rising demand for a yield instrument outperforming traditional fixed income. But as Saylor noted, that $100 mark is intentional—a ceiling, not a target. Any extra demand will be met with new STRC issuance.

In simple terms, Strategy can raise more capital, buy more Bitcoin, keep STRC as a $100 “stablecoin” stock with a 10% yield, and service interest payments without diluting common shareholders.

Good times indeed.

Stay safe and keep on stacking!

-Bam

Weekly Live Stream 🚨

Join Rob Wallace live today with Bitcoin News Weekly author Bam as they break down the week’s biggest headlines in their signature style.