- Bitcoin News Weekly

- Posts

- The Art of Doing Nothing

The Art of Doing Nothing

🚩 Why its easier to avoid a problem than solve it

Happy Friday Bitcoiners!

I just found 0.1 BTC in an old wallet I'd forgotten about.

Three years ago, I'd written it off as lost (spent weeks trying to recover it) when last week, while cleaning out an old laptop, there it was. Sitting in a random backup folder.

The Bitcoin was never lost. I just needed to stop frantically searching and let time do its thing.

That’s today’s lesson - sometimes the smartest thing you can do with Bitcoin is absolutely nothing.

We explore this in further detail by diving into👇

Why wisdom is in fact, prevention

The Sully Paradox: Why we shouldn’t celebrate disasters

A practical framework to prevent your future self from doing something stupid

Let's dive in⚡

"A clever person solves a problem. A wise person avoids it."

1) Why Wisdom = Prevention

Here's a truth that nobody wants to hear: Wisdom is boring as hell.

It doesn't make for engaging Twitter threads and won't get you invited on podcasts. And it definitely won't impress anyone at parties.

Why? Because wisdom equals prevention, and prevention is invisible to almost everyone. It's the trades you don't make, the altcoins you don't buy, and the leveraged positions you never open.

I learned this the hard way in 2022. Bitcoin was crashing and I was convinced I could time the bottom. My target? $14k. I had my finger on the trigger, ready to go all in when we hit my magic number.

Bitcoin bottomed at $15,588 (it hurts every time I think about it).

I waited for $14k. It never came. While I was trying to be clever and squeeze out an extra ~10% discount, Bitcoin doubled. Then tripled. My "smart" timing strategy cost me hundreds of thousands in missed gains.

Now I just DCA. Every week. Same amount. No thinking. No timing. No clever strategies. Boring as hell, but my stack grows steadily while the "traders" are still waiting for their perfect entry.

This is what Buffett and Munger understood better than anyone. Their entire investment philosophy boils down to: "Don't do stupid shit."

Not exactly inspirational poster material, but it's made them billions.

In Bitcoin, this principle is even more critical. The volatility that makes Bitcoin attractive also makes it emotionally exhausting. Your net worth can swing 30% in a week. That emotional rollercoaster pushes people to DO SOMETHING - anything - just to feel like they're actually in control.

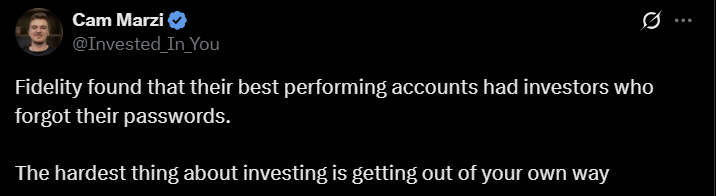

But here's the thing: Motion isn't progress. Activity isn't productivity. And in Bitcoin, action is often the enemy of wealth (interesting note - Fidelity’s best performing clients were those who did nothing👇).

As we explored in last week's newsletter about staying within your circle of competence, the smartest Bitcoiners I know have done precisely nothing for years. They bought. They held. They ignored the noise. And they're crushing everyone (including my past self) who's been unsuccessfully "actively managing" their position.

2) The Sully Paradox: Why We Celebrate Disasters Over Prevention

Remember Captain "Sully" Sullenberger? The pilot who landed US Airways Flight 1549 on the Hudson River after hitting a flock of geese?

Sully became an American hero overnight. Book deal. Movie starring Tom Hanks. Speaking engagements at $50,000 a pop. Sponsorship deals with everyone from Bose to Charles Schwab. The man turned a near-disaster into a multi-million dollar personal brand.

Now let me tell you about another pilot you've never heard of.

This pilot flew the same route hundreds of times. Each time, he adjusted his flight path slightly to avoid known bird migration patterns. No drama. No emergency landings. No passengers even knew he was protecting them. He retired after 30 years with a nice pension and zero name recognition.

Which pilot would you rather have flying your plane?

This is what I call the Sully Paradox - we celebrate those who brilliantly recover from disasters while ignoring those who prevent disasters from happening in the first place. Sully is a hero (and deservedly so), but the unnamed pilot who never hits birds in the first place? He's the real MVP.

The Bitcoin space is absolutely riddled with "Sully stories”. They're the traders who heroically "bought the exact bottom" (after losing 80% trying to catch the knife). They're the yield farmers of Blockfi and Celsius who "escaped just in time" (after losing half their stack learning that lesson). They're the ones with dramatic stories of recovery from dramatic mistakes.

Meanwhile, the prevention pilots are quietly stacking sats, avoiding the geese entirely. They're not huge on Twitter. They're not getting documentary deals on Netflix. They're just getting wealthy, slowly and steadily, by doing nothing dramatic at all.

I've been both pilots. The times I've been Sully make for great stories. The times I've been the ‘prevention pilot’ who avoided the birds? That's when I actually made money.

Guess which one I'm trying to be more often?

3) How to Master the Art of Doing Nothing

So how do you actually DO nothing when every fiber of your being is screaming at you to act?

Here's a practical framework for preventative wisdom:

Set Up Your Defense Today

The time to decide you won't panic sell isn't during a 40% crash - it's right now, when you're (hopefully) calm. This means:

Hardware wallet with a time delay (can't panic sell if it takes 24 hours to access).

Automatic DCA that you never touch (removes the decision to buy or sell entirely).

Written rules for when you're allowed to sell (hint: "because price dropped" isn't on the list).

Create Positive Constraints

Lyn Alden talks about this brilliantly - constraints aren't limitations, they're superpowers. Can't day trade if your Bitcoin is in cold storage. Can't panic sell if you've committed to a 4-year holding period. Can't FOMO into altcoins if you've publicly declared yourself Bitcoin-only.

This builds on the power of saying "no" quickly that we covered two weeks ago. These aren't restrictions - they're liberations from your future stupid self.

Embrace the Boredom

Preston Pysh says it best: "Bitcoin is get rich slowly." The slowly part is what breaks people. We're wired for action, programmed for instant gratification. Bitcoin rewards the exact opposite.

Your job isn't to optimize, trade, or time the market. Your job is to accumulate and wait. That's it. That's the entire strategy.

If that sounds boring, good. Always remember that boring is profitable.

Key Takeaway

The 0.1 BTC I "found" last week taught me something crucial: Most of our Bitcoin problems are self-inflicted. The coins weren't lost - I just needed to stop frantically trying to find them. The solution wasn't action; it was patience.

Wisdom equals prevention. Put systems in place today that prevent your future emotional self from doing something stupid. Because when Bitcoin's ripping up 20% or crashing down 30%, you won't be thinking clearly.

The best time to do nothing is right now, before you need to.

Remember: The captains who avoid icebergs never get famous. But they also never sink.

Stay boring, stack sats.

Sincerely,

@Publius256

Self Awareness Test 🎯Which "clever" Bitcoin strategy are you guilty of trying? |

Reply