- Bitcoin News Weekly

- Posts

- Washington DC Can’t Stop Talking About Bitcoin

Washington DC Can’t Stop Talking About Bitcoin

🏛️ Newly passed 'Genius Act' embeds Bitcoin ever deeper into the US monetary system.

Happy Monday Bitcoiners - it’s Bam here with another weekly update!

Each week, we condense the most impactful news releases into a concise, easy-to-read update so you’re always in the know!

Notable events this week include 👇

Trump supports scrapping capital gains taxes on small Bitcoin purchases.

El Salvador has stopped buying Bitcoin, per the IMF.

Adam Back’s BTC Treasury Co. aims to go public as the 4th largest.

Let’s dive in⚡

Ever thought of your tax bill when Bitcoin eventually hits $1M / coin?

With Bitcoin IRA you don’t have to worry about paying the government anything.

Avoid paying capital gains taxes on your Bitcoin (yes you read that right).

Convert your existing stock portfolio into direct Bitcoin exposure.

Minimize short term taxes by converting assets from your IRA.

Latest News 📰

🙌 Adoption

Bitcoin over Bluetooth is here. Bitchat now lets iOS and Android users send BTC directly, phone to phone, using built-in Cashu ecash wallets. No internet. Just instant, untraceable digital cash.

Bitcoin’s Realized Cap surpasses $1 trillion for the first time, 25% of it added in 2025 alone. Unlike market cap, it values each coin at its last moved price, giving a clearer picture of net investor inflows.

Strike launches Virtual USD accounts in 60+ countries, enabling users to deposit, buy Bitcoin, and withdraw cash faster and cheaper.

⚖️ Legal

The OCC, Fed, and FDIC issue joint guidance on crypto custody, where according to the rules, Banks can hold crypto for customers but must have full control of the keys to claim control.

The White House reaffirms that President Trump supports a de minimis tax exemption for purchases under $600 made with Bitcoin.

A FOIA request reveals the US Marshals hold just 29K BTC, only 15% of the 200K once believed. The low figure has sparked speculation of secret government sales, though it may only include forfeited (not seized) coins.

📈 Markets

Trump is set to open the $9T US retirement market to crypto, gold, and private equity. An executive order expected soon would let 401(k)s include alternative assets like Bitcoin.

US Bitcoin ETFs are on an 11-day inflow streak, adding $5B and pushing total inflows to $54.1B since launch. BlackRock leads with $2.4B this week and over 727,000 BTC, now the most profitable ETF in its lineup.

Australia’s first Bitcoin-backed home loan is set to launch after a hard-fought win over regulators. Rates start at 9.5% with a 40% Loan To Value (“LTV”), and rise to 11.93% with an 80% LTV.

🏦 Treasury

Strategy crosses the 600K BTC mark, now holding 601,550 BTC after acquiring 4,225 more for ~$472.5M. With a YTD BTC yield of 20.2%, their total stack was purchased at an average price of ~$71,268 per coin.

Adam Back partners with Cantor Fitzgerald to launch BSTR, a Bitcoin treasury firm going public with 30,021 BTC. The company also secured $1.5B in PIPE financing, a record for a Bitcoin SPAC deal.

The Smarter Web Company unveils a new valuation metric, P/BYD (Price to Bitcoin Yield & Deployment), to help investors evaluate Bitcoin treasury companies, similar to how P/E is used for traditional equities.

⛏️ Mining

French lawmakers submit a five-year bill to the National Assembly aimed at using excess energy, mainly from nuclear and renewables, to mine Bitcoin.

Canaan inks a deal to supply 6,840 A15Pro miners, manufactured in the US and Malaysia, to Cipher’s Black Pearl facility in West Texas, sidestepping tariff pressure and boosting American hashrate.

Riot Platforms trims its stake in rival Bitfarms to 9.8%, reducing exposure below the 10% threshold after selling 13.5M shares for $14.3M between July 3–16.

🗳️ Politics

Representative Marjorie Taylor Greene claims the signing of the GENIUS Act into law opens a backdoor to a central bank digital currency in the US.

Freddie New, Head of Policy at Bitcoin Policy UK, debunks Cabinet Minister Pat McFadden’s claim that Bitcoin political donations could enable foreign interference and challenges his talk of a potential ban.

IMF suggests El Salvador has stopped actively buying Bitcoin since signing its recent deal, instead consolidating existing holdings across government wallets.

🧠 Bitcoin Trivia 🧠

Answer Correctly 👉 Chance to Win 21,000 SatsWhat is the current circulating supply of Bitcoin? |

*Increased to 50,000 Sats for live viewers.

Bam’s 2 Sats 🧢

The Real Benchmark Has Changed

It seems like we’ve finally arrived. The arms race to acquire as much Bitcoin as possible is now led by institutions, and as they ramp up their accumulation, Bitcoin just hit a new all-time high of $123,000 this week.

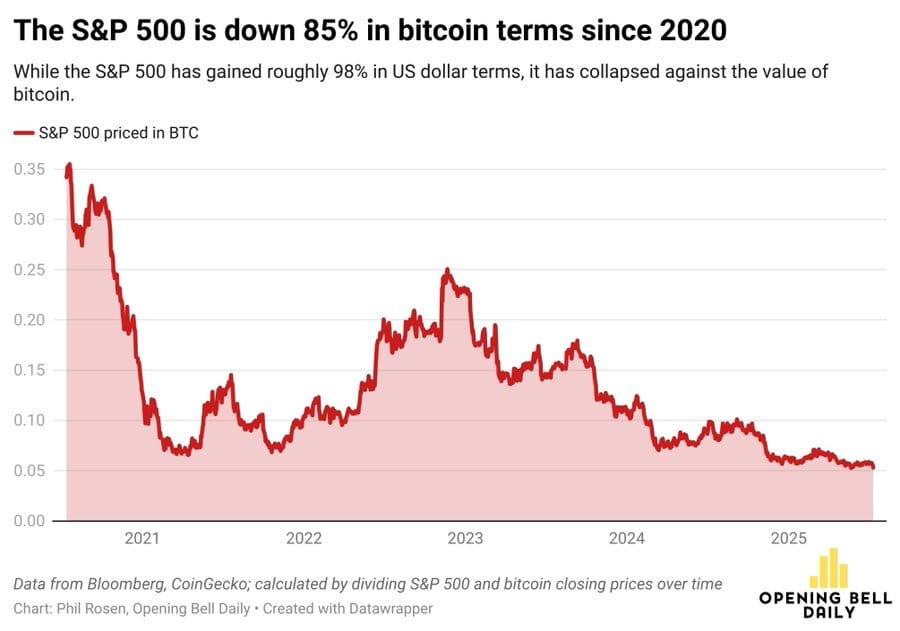

While it feels like everything is reaching new highs, the real benchmark is now being set by Bitcoin’s appreciation. Sure, the S&P 500 is up a staggering 100% in dollar terms since 2020. But priced in Bitcoin? It’s down 85%.

Bitcoin isn’t inherently hard to understand, but over the years, it has proven itself to be… well, mostly boring. Just a handful of days each year drive the massive upside. That makes it tricky for traders—especially those who once held a large position, only to let it go chasing short-term gains.

“I talk to my finance guy every day about stocks. We should’ve just shut up and bought BTC instead.”

Dave gets it. He might not have said it word for word, but what he was really getting at is the classic Bitcoin proverb: stay humble and stack sats.

Even legacy finance guys are starting to come around to the Bitcoin maximalist strategy of simply DCA’ing (Dollar Cost Averaging) and calling it a day.

But let’s not lose the plot. If your reasons are flawed, your conviction won’t last. We’re not buying Bitcoin because of Trump, or because Company X or Y validates it.

We buy Bitcoin because it’s the best store of value humanity has ever seen. Because it’s censorship-resistant. Because there will only ever be 21 million.

That’s the reason. Everything else is noise.

Stay safe and keep on stacking!

-Bam

Monday Live Stream🚨

Join Rob Wallace this Monday @ 11 ET as he sits down with The Bitcoin Way Co-Founder Tony to discuss how Bitcoiners can maintain the cause of freedom money in an increasingly regulated world.

Get Notified When We Go Live?Join a high signal Bitcoin community 👇 |

Trade Bitcoin On Multiple Exchanges

✅Access 20+ exchanges through a single unified experience

📈Advanced technical analysis tools (20,000+ trading instruments)

🏆Execute arbitrage opportunities across various exchanges

Reply