- Bitcoin News Weekly

- Posts

- Anchoring: The $1M Trap

Anchoring: The $1M Trap

🧠 How anchoring is distorting our perception of value

Happy Friday Bitcoiners!

Almost every Bitcoiner I know thinks BTC will hit $1,000,000 / coin. They don't know when, but they're sure it will happen (I too share similar conviction).

But here's my question: What will you do when it actually gets there?

Sell everything? Well, you just traded the hardest money ever made for fiat that loses 7%+ buying power each year. Keep holding? Then why does $1M matter to your plan?

Locking onto a round number like $1 million raises hard questions. If Bitcoin hits your target, will you sell just because it hit some made-up figure? If you plan to hold forever, why lock onto any price at all?

This week we dive into 👇

The two types of anchoring destroying (and building) Bitcoin portfolios

What anchoring actually is and how retailers weaponize it against you

How to use anchoring to stack more sats instead of selling too early

Let's get cracking!⚡

"The first number you hear tends to warp your judgment of all the numbers that follow"

1) Two Types of Anchoring In Bitcoin

Bad Anchoring: The "Too Expensive" Trap

The entire Bitcoin market waited patiently for Bitcoin’s price to cross into six figures. When it finally hit $100,000, everyone became convinced it would rocket to $250k immediately.

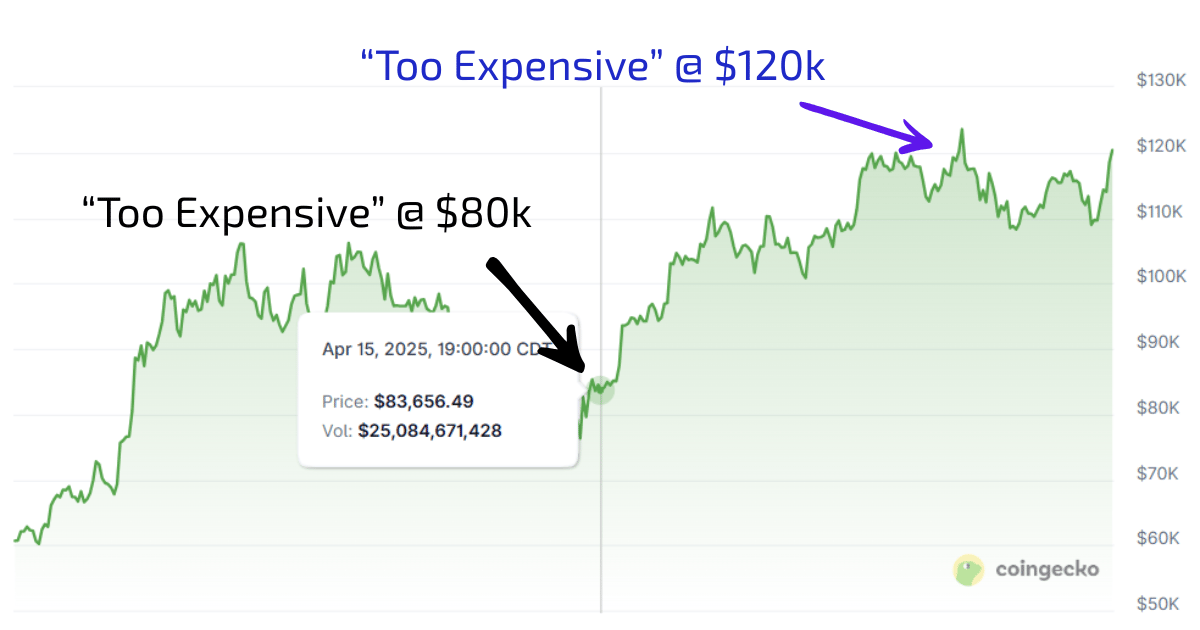

But what actually happened? Many of those who thought Bitcoin was "too expensive" at $80k missed out waiting for a dip that never came. Bitcoin ran to $120k, then pulled back to $100k. Those same people thought it was STILL "too expensive" at $100k because they were anchored to their initial $80k reference point.

Now Bitcoin is back near all-time highs and they've missed two opportunities to buy the dip they were waiting for.

This is anchoring at its most destructive. The fundamentals got stronger. Institutional adoption accelerated as fiat continued to debase. Hash rate hit new highs. But none of that matters when you're mentally locked to an arbitrary price from when you first paid attention.

The Percentage Anchoring Trap

Here's an even more insidious version: People think "Bitcoin is up 100% from $60k to $120k, so it's due for a correction." But $60k to $120k is the SAME percentage move as $300k to $600k. If you're anchored to percentage gains rather than fundamentals, you'll always sell too early.

The Bitcoiners who held from $100 to $1,000 made 10x. The ones who held from $1,000 to $10,000 also made 10x. Same percentage, different absolute numbers. Don't anchor to percentages or you'll be that guy who sold at $1,000 because "it already 10x'd".

Good Anchoring: The "Cheaper Sats" Mindset

Now here's the flip side: Many Bitcoiners who join our weekly Twitter spaces constantly mention how they're actively HAPPY when the Bitcoin price dips. Why? Because it allows them to buy more cheap sats.

These people are anchored to something much more powerful: their investment thesis. When Bitcoin goes lower, they buy more because their conviction surrounding Bitcoin's fundamentals remains unchanged.

They're not anchored to an entry price or round number. They're anchored to the belief that Bitcoin is the hardest money ever created, and any price lower than yesterday is a buying opportunity.

This is the difference between anchoring that destroys wealth and anchoring that builds it.

2) How Amazon Uses Anchoring Against You

Anchoring is a psychological phenomenon where your brain uses mental shortcuts to make judgments quickly. The problem? Those judgments aren't always accurate.

You see a "50% OFF!" sticker and your brain immediately thinks it's a good deal. But what if the original price was inflated to make the "discount" look attractive?

Amazon is notorious for this. A product normally sells for $50. Three weeks before Black Friday, Amazon raises it to $85. On Black Friday, they "discount" it to $55 with a "35% OFF!" tag.

You see that crossed-out $85 and think you're getting a steal at $55. In reality, you just paid 10% MORE than normal (yes, you got scammed!). Your brain anchored to that $85 number.

Source: Reddit

Charlie Munger watched this destroy investors for decades. They'd anchor to a stock's 52-week high and refuse to sell when fundamentals deteriorated. Or they'd anchor to their purchase price and miss massive gains because "it already went up so much" (sound familiar to anyone reading?).

In Bitcoin, where volatility is 10x higher than stocks, anchoring doesn't just cost you money. It can cost you generational wealth.

3) How To Use Anchoring To Your Advantage

Anchor To Fundamentals, Not Price

Stop asking "Is Bitcoin expensive at $100k?" and start asking "Are the fundamentals stronger than last year?"

Here's what actually matters: Value transferred across the Bitcoin protocol is up. Bitcoin held by institutions growing. Countries adding Bitcoin to reserves accelerating. These are anchors based on objective data, not emotion.

Source: River 2025 Adoption Report

Use DCA To Eliminate Single-Price Anchoring

You know what completely eliminates price anchoring? Never having a single entry price to anchor to.

I DCA every week. Same amount. Every time. I've bought at $20k, $60k, $100k, and everywhere in between. There's no single price I'm anchored to, so I can't feel "right" or "wrong" based on short-term moves.

As we learned in The Art of Doing Nothing, the best performing accounts consistently accumulate. No clever strategies. Just boring, systematic buying that removes the anchor entirely.

Reframe The ‘$1,000,000 per Bitcoin’ Question

Let's go back to where we started: What happens when Bitcoin hits $1 million?

If you're planning to sell, ask yourself: "Why would I sell my best-performing asset?"

$1 million isn't a ceiling. It's confirmation you were right to hold. The real question isn't "Should I sell at $1M?" It's "What am I selling INTO?" Fiat currency that's guaranteed to debase? Stocks at nosebleed valuations? Real estate that requires maintenance and can't cross borders?

When you reframe it this way, the $1M stops being an anchor and becomes just another milestone on Bitcoin's journey.

Key Takeaway

Anchoring is powerful, and if you're not aware of it, it will sabotage your decisions.

You're anchored to round numbers like $1M even though there's nothing special about that price. You're anchored to the price when you first heard about Bitcoin, making everything else feel "expensive".

The fix? Anchor to the right things. Anchor to fundamentals that are objectively strengthening. Anchor to your investment thesis, not your entry price. Anchor to time horizons, not price targets.

And when Bitcoin hits $1 million, don't let that anchor trick you into selling the hardest money ever created just because it reached a psychologically satisfying number.

Because the most expensive Bitcoin you'll ever not buy is the Bitcoin you sell too early while anchored to an arbitrary price target.

Stay level headed,

@Publius256

Mental Trap CheckWhat Bitcoin price are you most anchored to? |

Reply