Happy Monday Bitcoiners - it’s Bam with another weekly update!

Each week, we condense the most impactful news releases into a concise, easy-to-read update so you’re always in the know!

Notable events this week include 👇

A whale holding 150K+ BTC dumps 24K on a quiet Sunday.

The President’s son hints countries are secretly stacking Bitcoin.

Strategy upsets shareholders by sending mixed messages.

Let’s dive in⚡

Weekly Live Stream 🚨

Join Rob Wallace today for a live conversation with Car González, CEO & Co-Founder of PlebLab, Bitcoin’s leading hackerspace and builder accelerator, as they break down the biggest Bitcoin headlines and the latest from the builder scene.

Get Notified When We Go Live?

Latest News 📰

🙌 Adoption

Argentina launches “BA Cripto,” enabling residents and businesses to pay city taxes and fees with Bitcoin. Eligible payments include property tax (ABL), vehicle tax, driver’s licenses, traffic fines, and more.

TFTC releases a viral two-minute AI-made mini-movie explaining the devastating fallout from the US abandoning the gold standard.

Bitcoin tipping is now live on X, powered by BitBit and Spark. The feature lets 500M users receive instant bitcoin payments without a wallet, using BitBit’s self-custodial browser extension.

⚖️ Legal

Pennsylvania bill seeks to bar public officials from holding Bitcoin. HB1812 sponsor Rep. Ben Waxman says he was motivated by perceived “corruption” at the federal level, citing President Donald Trump.

US Justice Department says it won’t target developers of decentralized crypto platforms absent criminal intent. Writing code isn’t a crime, and failure to register as a money transmitter won’t trigger charges.

Tether appoints Bo Hines as Strategic Advisor for digital assets and U.S. strategy, shortly after his resignation as Executive Director of the White House Crypto Council.

📈 Markets

Bitwise processes the first-ever in-kind creation order for a Bitcoin ETF. An Authorized Participant exchanged BTC directly for ETF shares, potentially tightening spreads and reducing fees for investors.

The probability of positive Bitcoin returns rises with time: 53.1% over 1 day, 55.7% over 1 week, 57.8% over 1 month, 76.5% over 1 year, 99.3% over 3 years, and 99.8% over 5 years.

Wells Fargo increased its holdings in BlackRock’s iShares Bitcoin Trust from $26M to over $160M in Q2 2025, according to SEC filings.

🏦 Treasury

Strategy updates its equity guidance, saying it may issue additional MSTR shares below an mNAV of 2.5x “if deemed advantageous,” a reversal from its statement just three weeks ago on the Q2 earnings call.

Amsterdam Digital Asset Exchange (AMDAX) plans to launch Amsterdam Bitcoin Treasury Strategy (AMBTS), aiming to accumulate 1% of the total Bitcoin supply.

Metaplanet has been upgraded from Small Cap to Mid Cap in the latest FTSE review, adding it to the FTSE Japan and World Indexes and positioning it to attract billions in passive inflows.

⛏️ Mining

The BBC airs an 8-minute segment on Bitcoin mining in Ethiopia, which now accounts for 5% of global hash rate and generates over $200M annually for the country’s largest power company.

Vancouver is considering using Bitcoin miners to heat the Kitsilano Pool, a plan that could keep it open year-round while generating up to $1M in profit for the city.

Tajikistan lost more than $3.5M in H1 2025 from illegal Bitcoin mining, according to Attorney General Khabibullo Vokhidzoda. Unauthorized electricity use forced the state to cover power provider losses.

🗳️ Politics

A Philippine legislator has proposed a Strategic Bitcoin Reserve, requiring the BSP to purchase 2,000 BTC annually for 5 years and hold it for 20 years to strengthen national security and debt stability.

The Winklevoss twins donate 188 BTC ($21M) to the Digital Freedom Fund PAC, a pro-digital asset group aligned with President Donald Trump, to support Republicans in the midterm elections.

Eric Trump suggests that a mystery country may have secretly purchased 200,000 BTC, worth about $22B.

🧠 Bitcoin Trivia 🧠

Answer Correctly 👉 Chance to Win 21,000 Sats

Bam’s 2 Sats 🧢

Trust the signal, ignore the noise

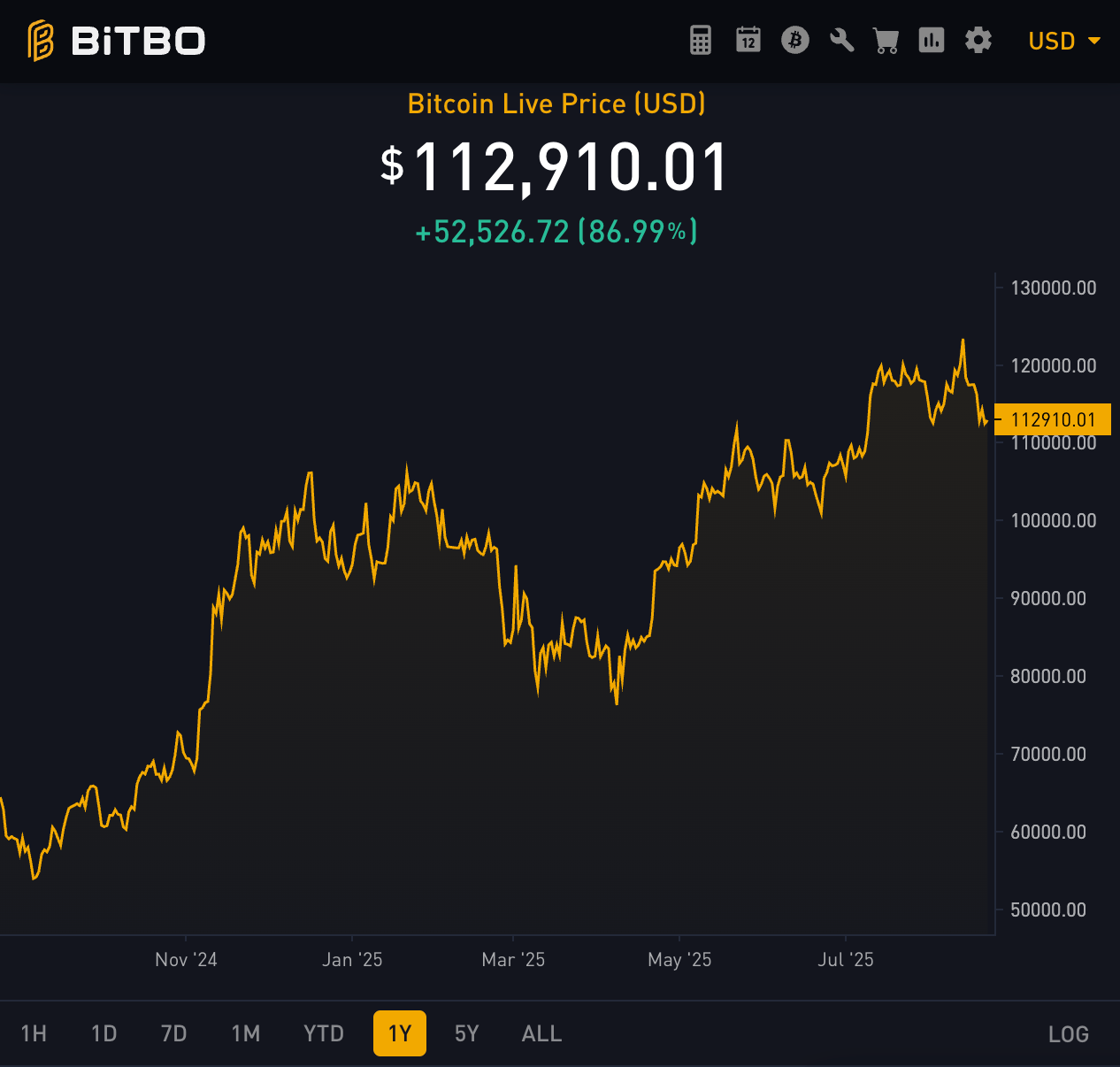

If you’d told me a year ago, when Bitcoin was $60K, that it would hit $124K, hold above $100K for three months, trade today at $113K, and see 150+ companies adopt a Bitcoin treasury strategy… only for people to still be bearish, I wouldn’t have believed you.

Bitcoin is up nearly 90% from last year. Yet on X, every dip still triggers the same cycle of fear:

Are the Bitcoin treasury companies slowing their buys?

Will ETFs holders start to unwind their positions?

Is the top in?

Every dip revives the same macro fears: shaky stocks, tariffs, no Fed cuts, rising wars. The familiar “this time it’s different” doom loop.

But those takes keep missing the stronger signal we see week after week.

On one hand, price is ripping. Compared to last year, Bitcoin has shattered the 50–60% CAGR expectation.

On the other hand, new buyers are entering at scale. Last week alone, first-time holders added ~50,000 BTC, bringing their total to nearly 5 million. With BTC treasuries, ETFs, and more, the adoption curve is alive and well.

To me, there are two kinds of investors:

Bitcoiners - they’ve accepted Bitcoin’s inevitability, zoom out, stack, and live their lives.

Traders - they’re stuck in the “crypto” game, bitter over the altcoin season that never came, calling tops at every correction.

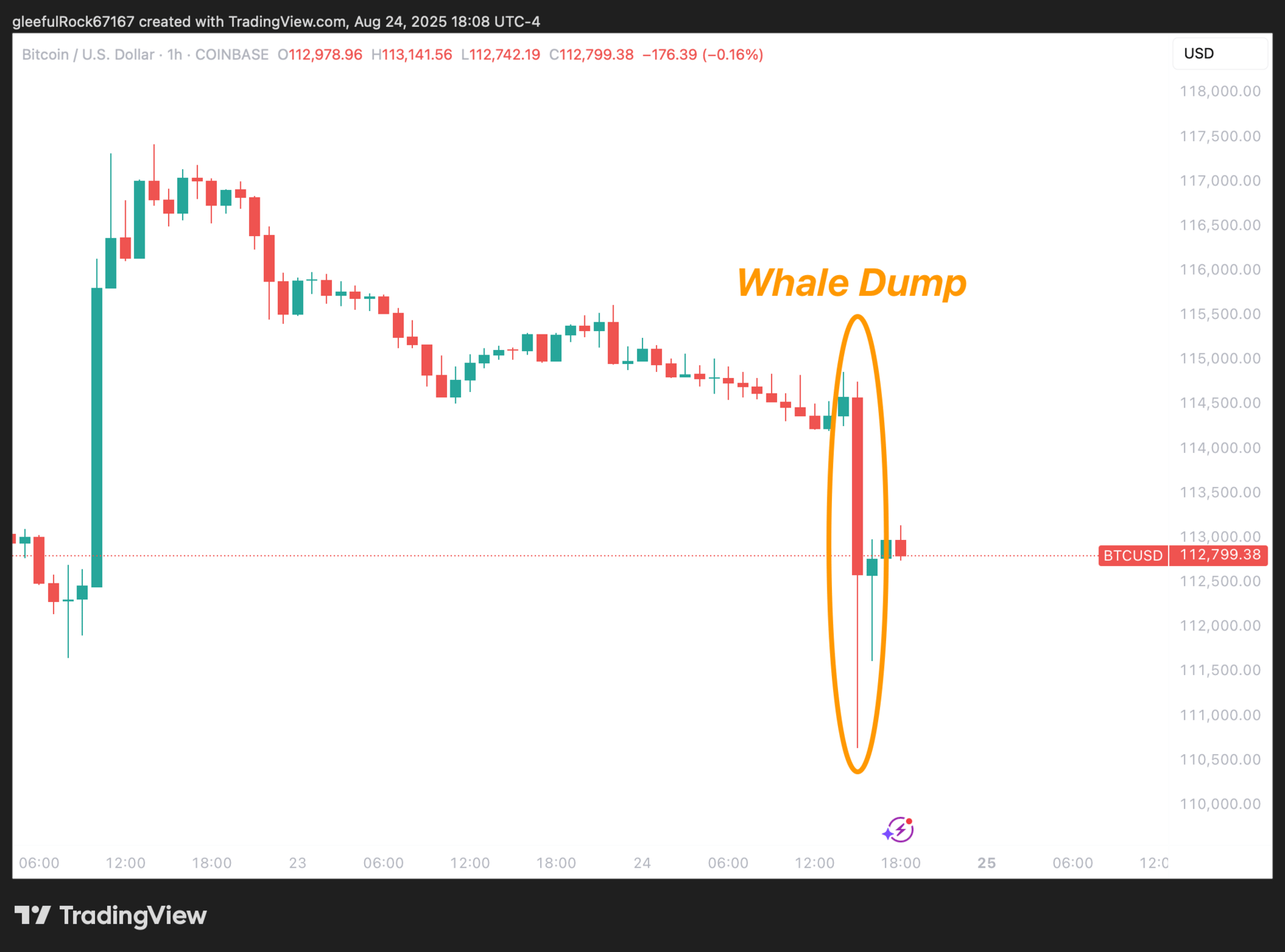

One thing is certain: whales still play games with this market. On Sunday, a single whale sparked a $310M Bitcoin flash crash by dumping 24,000+ BTC. The entity still holds 152,874 BTC across linked wallets, with funds originally traced back to HTX deposits six years ago. Bitcoin fell $4,000 in an hour but quickly recovered to its Friday price.

The smartest move is to learn how to “do nothing”.

Stack, stay patient, build yourself, and enjoy the people around you. Bitcoin is fine. Every signal confirms it. The only question is whether you’ll trust the signal or keep chasing the noise.

Stay safe and keep on stacking!

-Bam